venmo tax reporting limit

Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. The charge is a 175 percent fee with a minimum of 025.

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

So if your business received 600 or more on Venmo PayPal or another P2P app those.

. Venmo has a rolling weekly limit of 29999 for unverified accounts and 699999 for verified accounts. For most states the threshold. In this photo illustration a.

Rather small business owners independent. The American Rescue Plan Act lowered the threshold for reporting P2P network transactions to 600. Read on for more information about these limits.

Venmo PayPal and Zelle. Increased Tax Reporting on Payment App Transactions. This new rule wont affect 2021 federal tax returns but now.

Its important to make sure that your tax information on Venmo matches IRS records so were here to help if you need to change the info on your tax forms. PayPal Zelle Venmo Taxes. TPSOs like PayPal and Venmo.

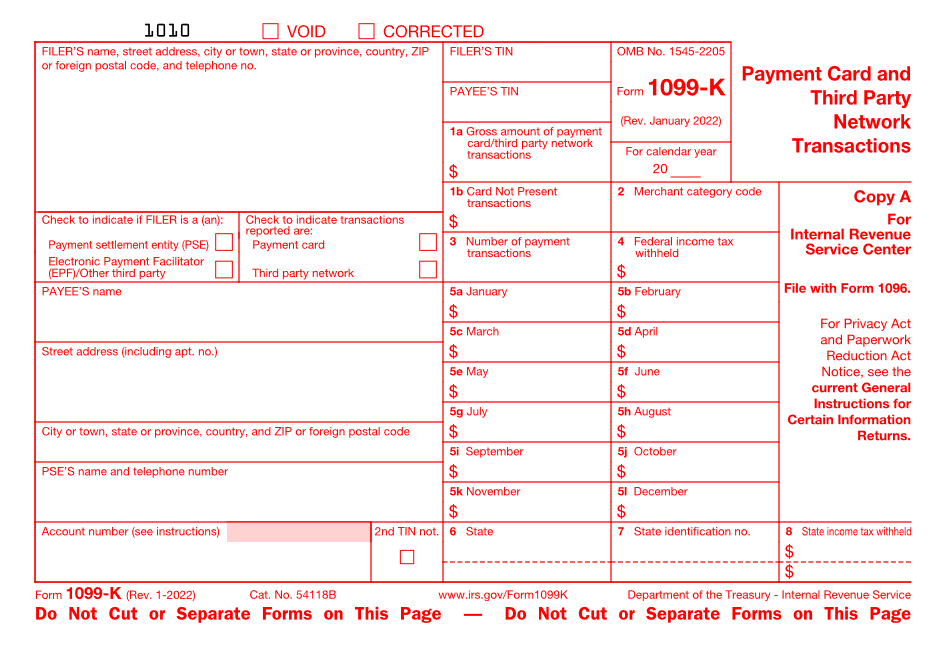

Venmo has some limits on how much you can send in a given week. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. If youre using a business profile on Venmo visit this article for more information on tax reporting.

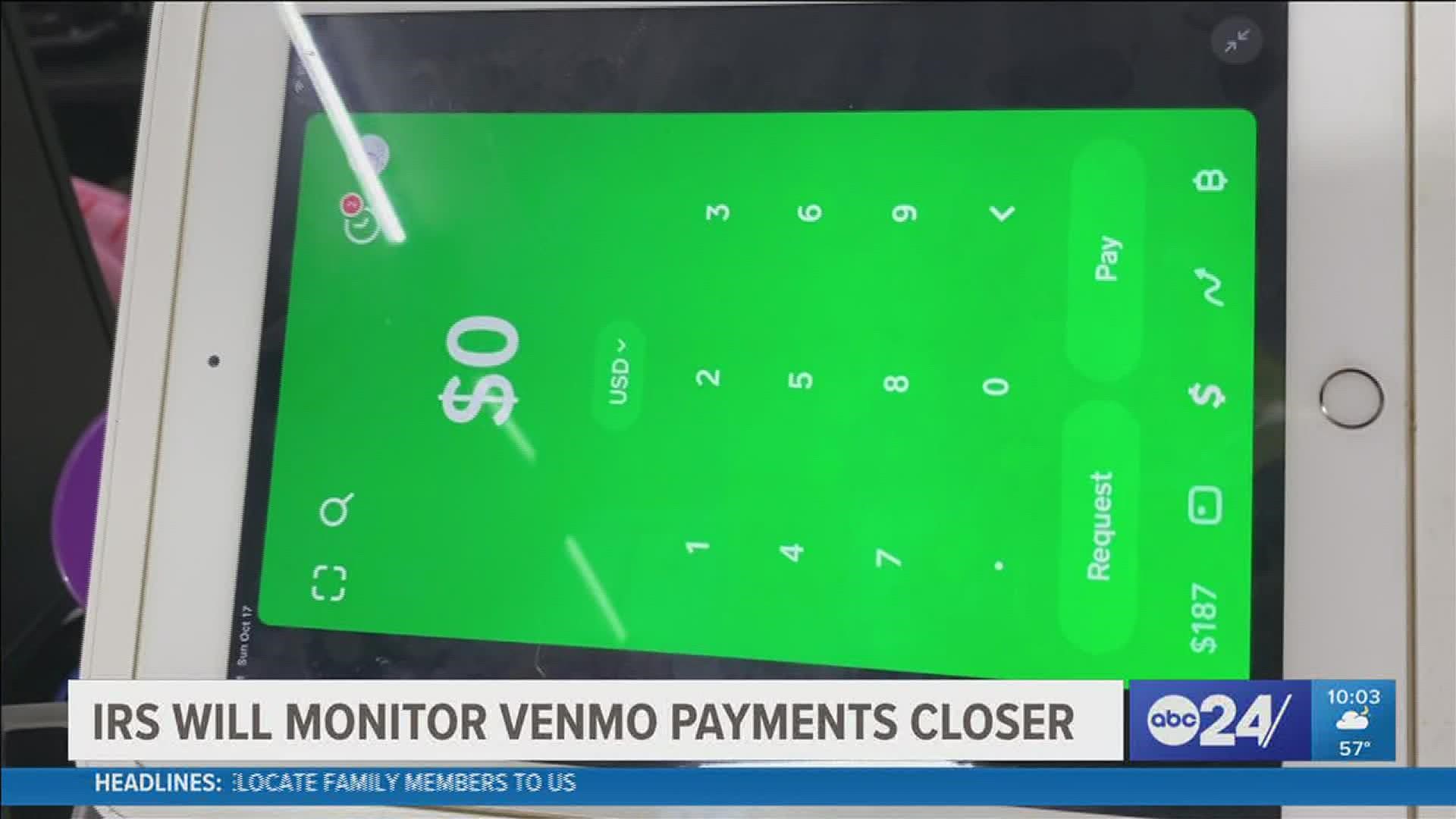

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. There isnt a daily limit when using Venmo but you cant make. If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit.

Terminate this user agreement limit your Venmo andor PayPal account andor close or suspend your Venmo andor PayPal account. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider Paxos Trust Company. Taxes and Information Reporting Our fees do not include any taxes levies duties or similar governmental assessments of any nature including for example value-added sales.

If you have not yet completed identity verification you will have. How these new tax reporting changes may impact you when paying or accepting payments with PayPal and Venmo for goods and services. New Tax Reporting Rules.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Venmo CashApp and other third-party. If you dont have a business profile but frequently use Venmo to sell goods or services we.

Previously limits surrounding reporting of income received through payment cards and third-party. Jan 25 2022 157 PM. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

For the 2021 tax year Venmo will. Consider seeking advice from your financial and tax advisor. What Your Business Needs To Know.

By Tim Fitzsimons. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

Venmo Paypal And The Irs Here S What You Need To Know

Network Payment Reporting Threshold Of 600 Goes Into Effect Frazier Deeter Llc

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

1099 K Changes What Do They Mean For Your Side Hustle Ramsey

New Tax Code Rules In 2022 Eyewitness News

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Venmo And Paypal Will Now Share Your Transactions With The Irs If You Make More Than 600 A Year On The Platforms The Washington Post

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

New Reporting Requirements For 1099 K

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

New 1099k Threshold Change 600 Taxes Can I Avoid Irs Tax Form For Venmo Paypal Cashapp Zelle Youtube

Venmo Paypal Cash App Zelle Must Now Report Payments Of 600 Or More To Irs Spectacular Magazine

Will The Irs Track Every Venmo Transaction Fact Checking Financial Reporting Plans

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos