indiana employer payroll tax calculator

Could be decreased due to state unemployment. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

How To Calculate Payroll Taxes Methods Examples More

Indiana Hourly Paycheck Calculator.

. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. So the tax year 2022 will start from July 01 2021 to June 30 2022. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

The maximum an employee will pay in 2022 is 911400. If you have employees working at your business youll need to collect withholding taxes. Percent of income to taxes 31.

Indiana SUI Rates range from 050 to 94 for 2021. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only. Medicare 145 of an employees annual salary 1.

Total Estimated Tax Burden 23164. These are state and county taxes that are withheld. Sales Tax 1382.

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. The state income tax rate in Indiana is a flat rate of 323. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Indiana new employer rate excluding government and. Indiana sui rates range from 050 to 94 for 2021. It is not a substitute for the advice of.

Indiana State Unemployment Insurance SUI Indiana Wage Base 9500 for 2021. Just enter the wages tax withholdings and other information required. Created with Highcharts 607.

Indiana Salary Paycheck Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The standard FUTA tax rate is 6 so your max.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator can determine overtime wages as well as calculate the total earnings. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Indiana.

In either case employers must pay employees. Indiana Income Tax Brackets and Other Information. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Indiana law requires employers to pay most employees at least twice per month and an employee may request to be paid on a bi-weekly basis. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Use the Indiana paycheck calculators to see the taxes on your paycheck. A state standard deduction exists in the form of a personal exemption and varies. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

You can actually lower your taxable income by.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

1099 Tax Calculator How Much Will I Owe

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Indiana County Income Taxes Accupay Tax And Payroll Services

Indiana Paycheck Calculator Smartasset

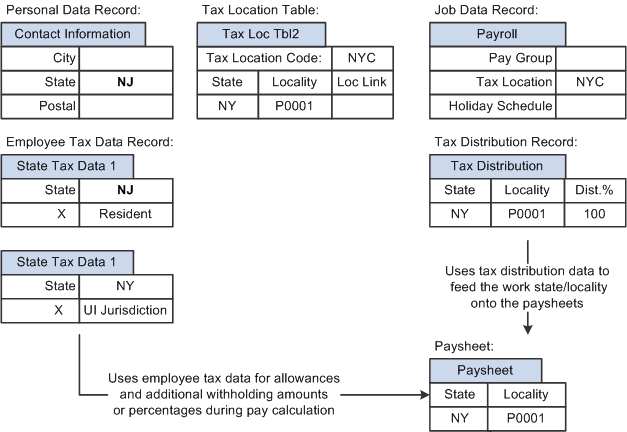

Peoplesoft Payroll For North America 9 1 Peoplebook

Llc Tax Calculator Definitive Small Business Tax Estimator

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

The Ultimate Guide For Quarterly Tax Filing Requirements For Indiana Employers

Employer Payroll Tax Calculator Free Online Tool By Incfile

How To Pay Your Nanny S Taxes Yourself Diy For Paying Household Employees

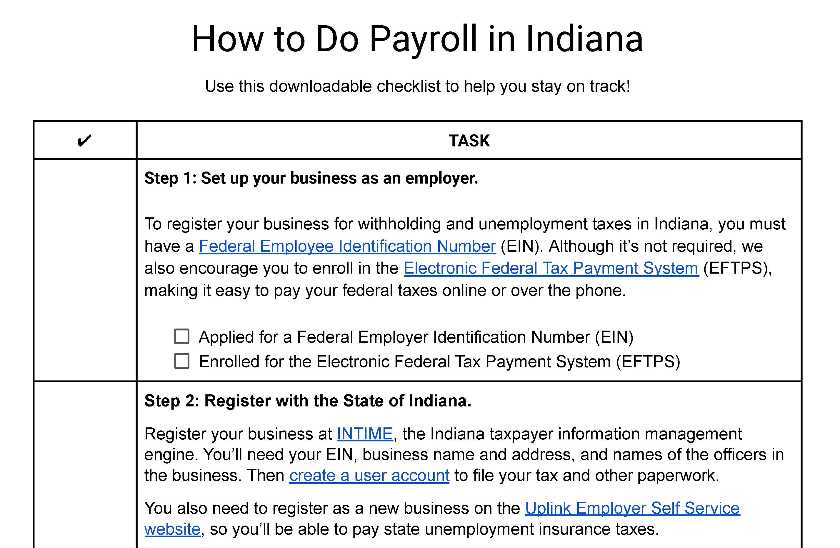

How To Do Payroll In Indiana What Every Employer Needs To Know

Many Employers To Start Collecting Wa Cares Payroll Tax On January 1 Washington Thecentersquare Com

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified